Partnering With Community Banks Nationwide Since 1998

PCI Performance Management is a community bank consulting firm serving our clients since 1998. PCI Performance Management offers a portfolio of consulting services including strategic planning, operational efficiency, organizational alignment, C-suite manager resources, and executive management coaching.

PCI Performance Management is passionate about community banking! Our mission is to offer key insights and tools to drive executives to the next level. We approach each of our clients with fresh eyes to develop customized, unique strategies.

Are you ready to set your business on the path to success? Let’s connect and take your organization to the next level.

You got questions, we've got answers...let's connect!

Contact us today to get started and learn more about our process and how we work with community banks like yours.

The Mandate For Change In Community Banking

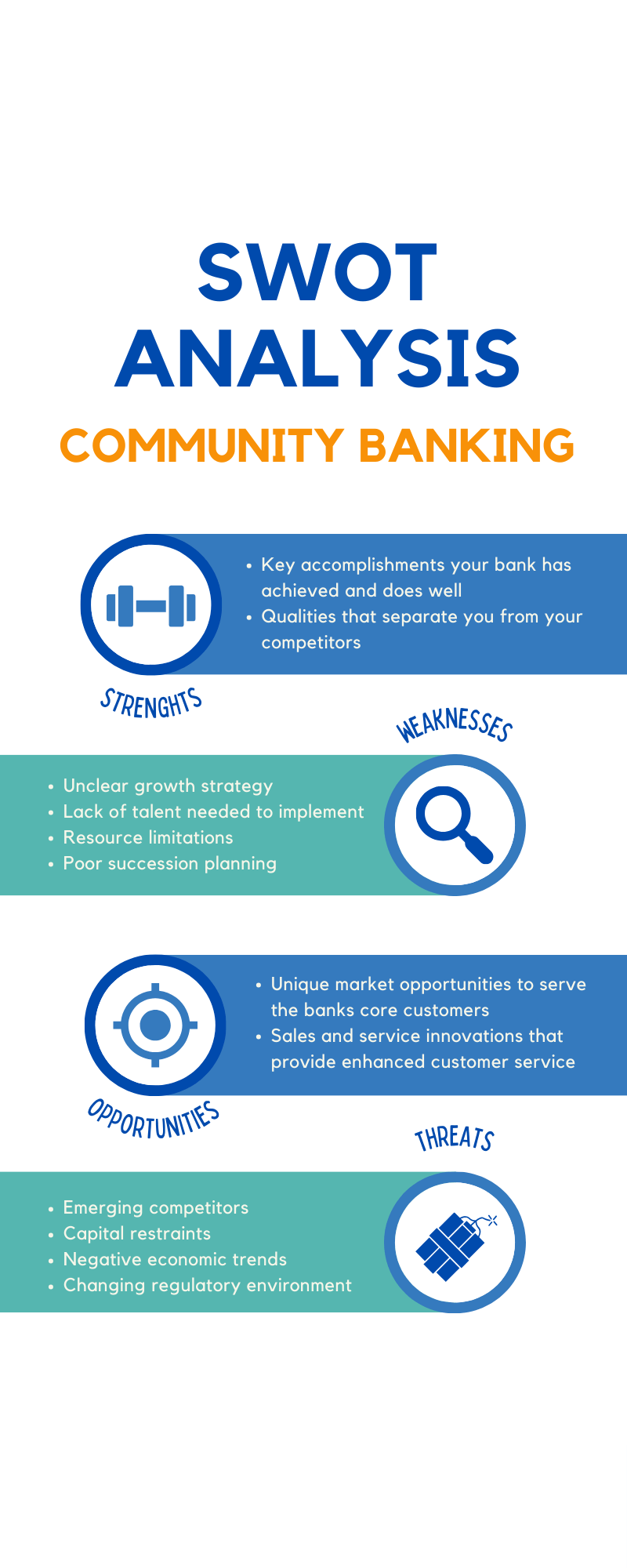

Today’s playing field has changed more dramatically in the last ten years than it has in the previous forty years. Now, more than ever, community banks must design and implement new strategies. The playing field is drastically different than only a few years ago.

The financial industry has undergone a significant transformation over the last decade, and community banks have not been immune to these changes. In fact, the playing field has shifted more in the last ten years than it has in the previous forty. As a result, community banks must adapt and develop new strategies to remain competitive.

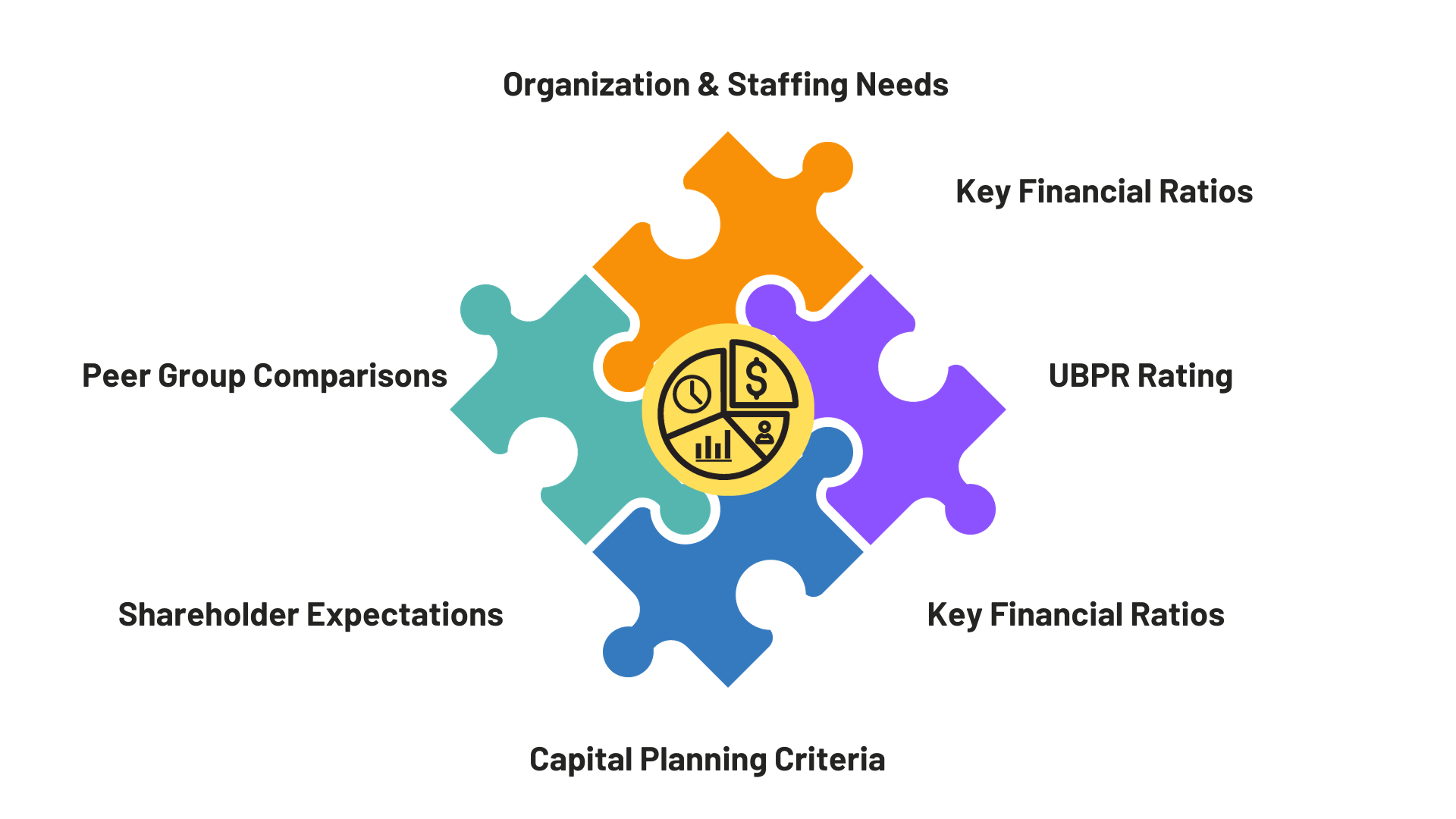

Key Factors Driving Community Bank Strategy

Smart community bankers recognize that strategic planning is a critical activity for their bank. This is the process where senior executives, shareholders, and board members discuss the current state of affairs and lay out a road map for the future of the bank.

While regulators are increasingly demanding that community banks have a strategic plan, it serves to create a unified vision for the bank’s goals and is an excellent tool to help communicate these goals to staff.

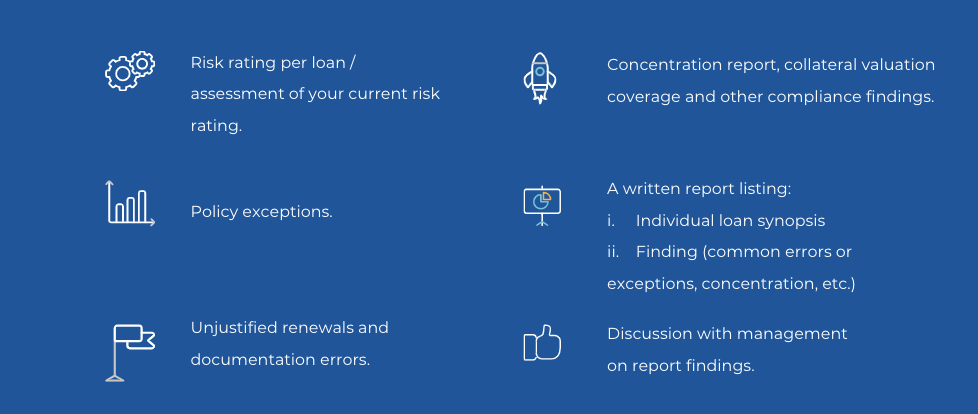

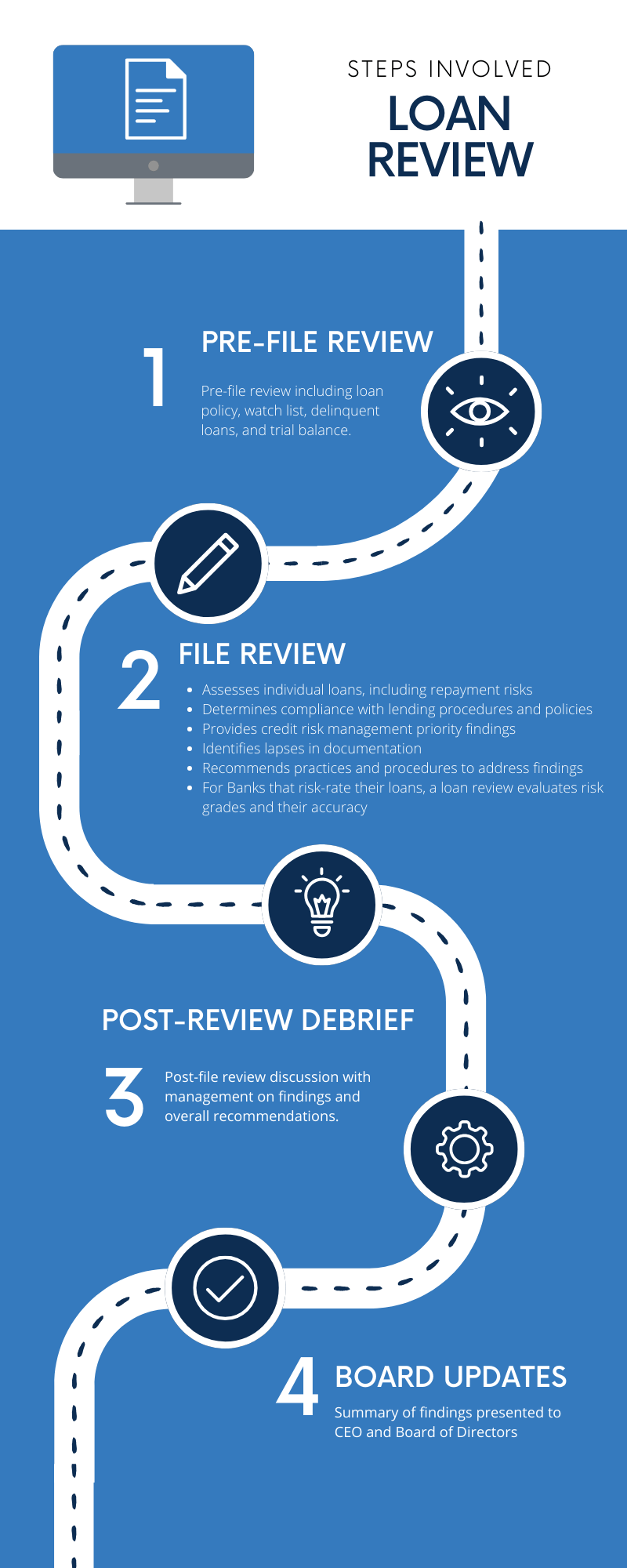

Loan Review, Loan Policy and CECL

Effective loan portfolio management is crucial to controlling credit risk. In order to control risk, a Bank must know the types and levels of credit risk in its portfolio. Loan review is an important tool that can help Banks identify this risk. A loan review provides an assessment of the overall quality of a loan portfolio.

PCI will produce and deliver all topics listed below, for each file and concentration we review, including an overall summary of findings and recommendations for improvement.

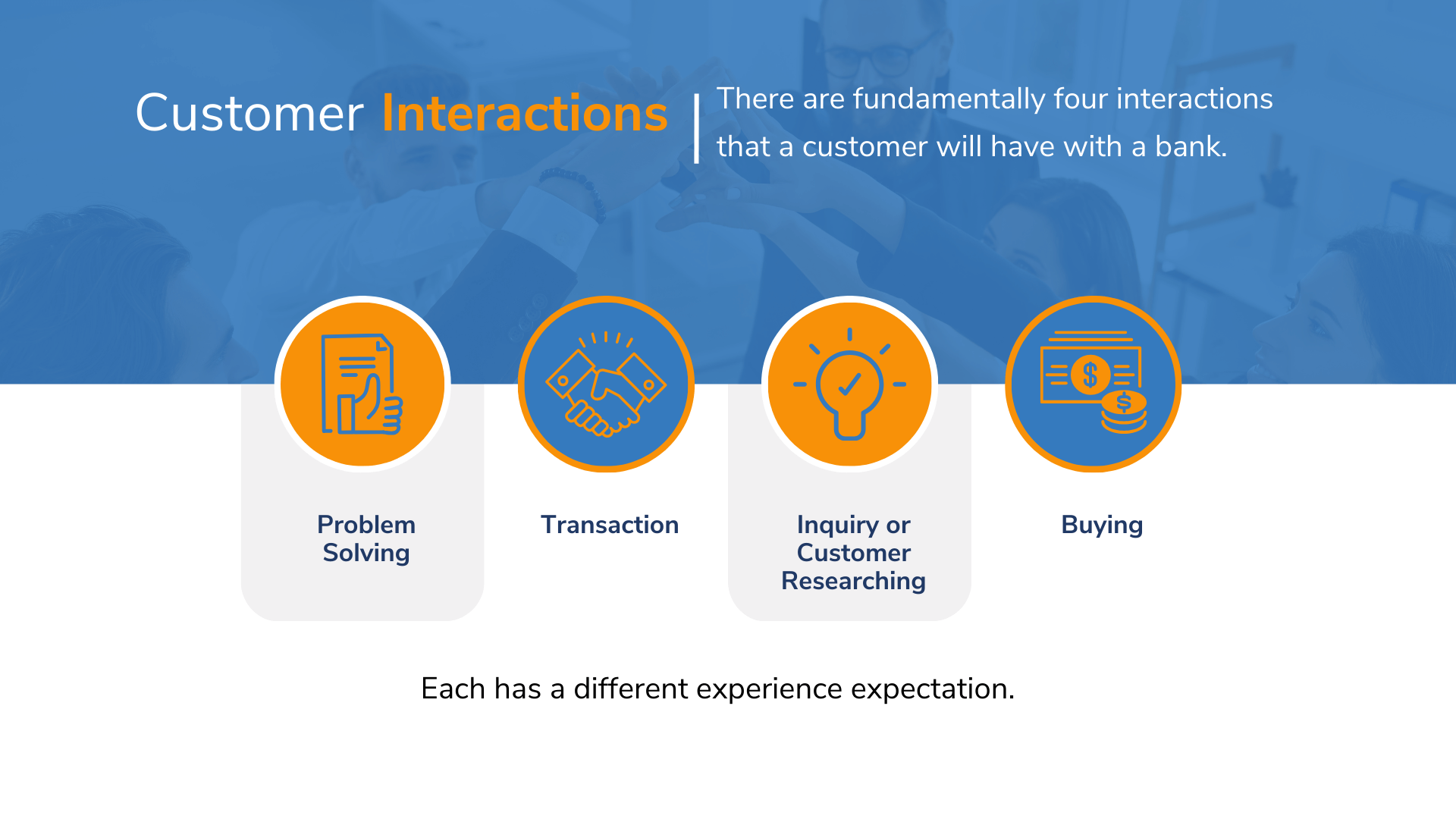

The Ever Changing Customer Experience

Community Banking customers are more savvy than ever before. Isn't time your customer experience not only meets their needs but seeks to exceed their expectations - across all customer touchpoints?

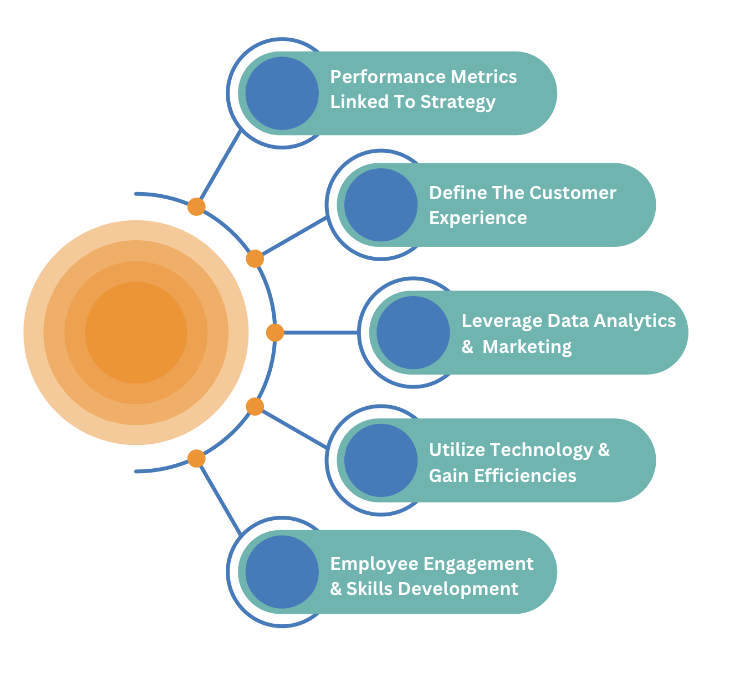

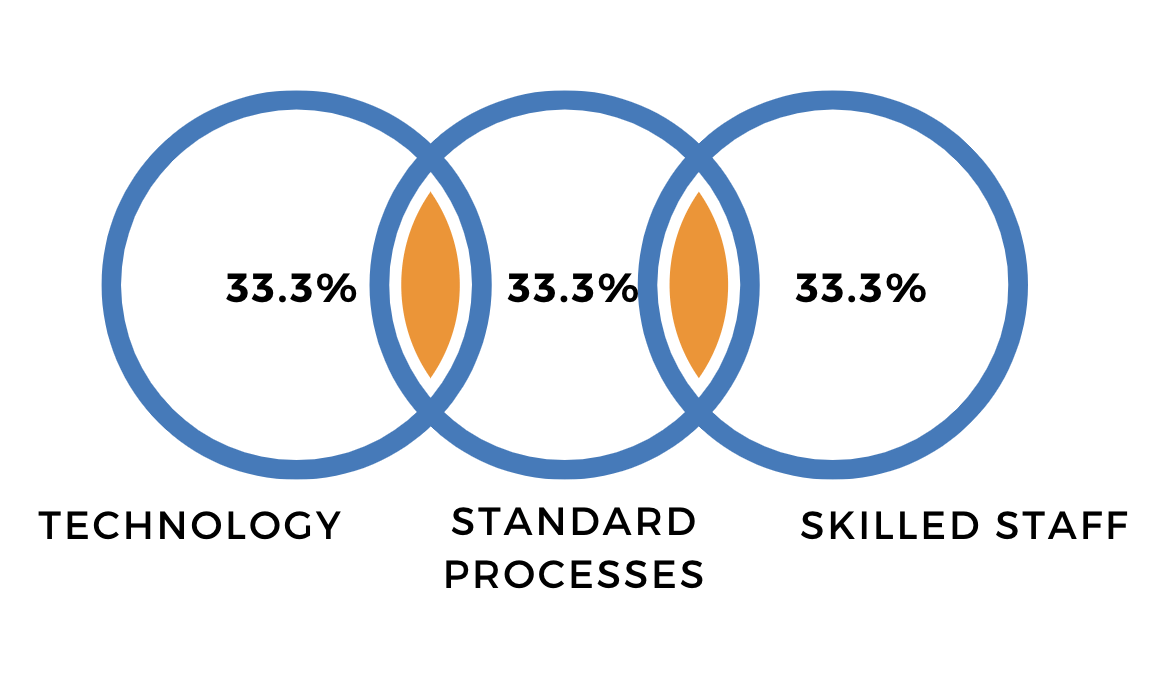

Five Ways to Improve Operating Efficiency

Community Banks must design and maintain a highly efficient operating environment that strives to embrace a philosophy of continuous improvement.

The playing field is drastically different than only a few years ago. The need for seamless banking API and Fintech integrations that drive a more technology-friendly customer experience and internal workflow processes.

Workplace DiSC Assessments

PCI Performance Management is proud to be an authorized partner and certified facilitator for Wiley Everything DiSC.

Everything DiSC offers highly adaptive, human-centered solutions that transform the typical,

day-long event into an ongoing learning process, that works.

Recent Articles

Industry Trends Affecting Community Banks

Copyright PCI Performance Management