The Mandate for Change | Why Now?

Today’s playing field has changed more dramatically in the last ten years than it has in the previous forty years. Now, more than ever, community banks must design and implement new strategies. The playing field is drastically different than only a few years ago.

The financial industry has undergone a significant transformation over the last decade, and community banks have not been immune to these changes. In fact, the playing field has shifted more in the last ten years than it has in the previous forty. As a result, community banks must adapt and develop new strategies to remain competitive.

One of the most notable changes in the industry is the rapid advancement of technology. Customers now expect to be able to conduct their banking activities online or through mobile apps. As such, community banks must invest in these technologies to meet customer demands and stay relevant.

Another change is the increased competition from non-traditional financial institutions, such as fintechs and online lenders. These companies often provide faster and more convenient services, which can be attractive to consumers. Community banks must differentiate themselves by offering personalized services and building strong relationships with their customers.

Community banks must embrace the changing landscape of the financial industry and develop new strategies to remain competitive. This means investing in technology, offering personalized services, and building strong relationships with customers. By doing so, community banks can continue to thrive in the years to come.

Banks are seeing less lobby traffic. Customers are coming into the bank less frequently than in previous years. Many community banks have experienced up to a 30% drop in lobby traffic over the past three years and most see that trend continuing.

The banking industry has seen a significant shift in customer behavior over the past few years. With the rise of online banking and mobile apps, customers are now choosing to do their banking transactions from the convenience of their homes or on-the-go. This shift has led to a decrease in lobby traffic for many community banks across the country.

In fact, some banks have reported up to a 30% drop in lobby traffic over the past three years, and this trend is expected to continue. While some customers still prefer to conduct their transactions in person, the majority are opting for the convenience of digital banking options.

Banks are adapting to this new trend by investing in their online and mobile banking platforms, offering more services and features to customers who prefer to bank digitally. This not only meets the needs of customers but also helps banks to operate more efficiently by reducing the need for physical branches and staff.

The shift towards digital banking is transforming the industry and changing the way customers interact with their banks.

The ease of technology, through direct deposit, mobile banking, mobile deposit, internet banking, and ATMs have reduced the need for customers to come into their bank to complete transactions. Most banks have seen a dramatic increase in the volume of electronic customer transactions.

The convenience of modern technology has revolutionized the banking industry, making it easier than ever before for customers to manage their finances. Thanks to features like direct deposit, mobile banking, mobile deposit, internet banking, and ATMs, customers no longer need to physically visit their bank to carry out transactions.

As a result, banks have seen a significant increase in the number of electronic transactions being processed. This has led to improved efficiency, reduced wait times, and a better overall customer experience. With mobile banking, customers can easily access their account information, transfer funds, and pay bills from the comfort of their own homes or while on the go.

However, it's important to note that some customers may still prefer to visit their bank in person, especially for more complex transactions or to receive personalized assistance from a banking professional. It is crucial for banks to offer a variety of options to meet the needs of all their customers.

Customers are not loyal to one institution. In any meeting, even a board meeting, it is highly unlikely that even one person has all of their financial services and products with one bank. Customers have credit cards, investments, PayPal, Venmo, and a host of other financial services that are not with one banking institution.

In today's world, people have a wide range of financial needs and preferences, and they often turn to multiple providers to fulfill those needs. This means that the days of "one-stop shopping" for financial services are largely over.

It's not uncommon for someone to have accounts with multiple banks, credit unions, and other financial institutions, each of which serves a different purpose. Some people might have a checking account with one bank, a savings account with another, and a credit card from a third. Others might use PayPal or Venmo to manage their online transactions.

The reasons for this diversification of financial services are many. For one thing, people want to find the best deals and the most convenient options for their specific needs. They might choose one bank for its low fees, another for its high-interest savings account, and a third for its rewards credit card. Additionally, people are increasingly comfortable with using digital tools and apps to manage their finances, which means they have more options than ever before.

As a result, banks have had to step up their game to meet the changing needs of their customers. The rise of information technology has empowered bank customers with knowledge and made them less loyal to a single financial institution. Banks have responded by offering more personalized products and investing in technology to provide a better customer experience.

Community banks’ internal technology has revolutionized a bank’s ability to provide efficient delivery of retail products. This technology has allowed banks to profile a customer and cross-sell at the point of sale. This is critical for deepening customer relationships.

The scale of more sophisticated internal technology in community banks has been a game-changer in the banking industry. By understanding the needs and preferences of their customers, banks can offer tailored solutions that match their requirements. This not only helps to increase customer satisfaction but also boosts customer loyalty.

Reaching out to bank customers has taken on new approaches through digital marketing and customer personalization of the overall customer experience. Banks are questioning the value of traditional media in lieu of demographic-specific marketing strategies.

Digital marketing has revolutionized the way banks reach out to their customers. With the abundance of data available, banks are now able to personalize the overall customer experience and target specific demographics with tailored marketing strategies. This has led to banks questioning the value of traditional media, such as television and print advertisements.

Instead, banks are focusing on demographic-specific marketing strategies that allow them to reach the right customers at the right time with the right message. By leveraging data analytics and artificial intelligence, banks can gain insights into customer behavior and preferences, allowing them to create more effective marketing campaigns.

Furthermore, customer personalization has become a key factor in the overall customer experience. Banks are now able to provide customized offers and solutions based on individual customer needs and preferences, leading to greater customer satisfaction and loyalty. As the banking industry continues to evolve, it is clear that digital marketing and customer personalization will play an increasingly important role in the success of banks.

Business Lines

Background

It is important to recognize the three major business lines within a community bank. There are three major business lines that need to be considered within the bank - each having unique customer expectations and unique customer service standards.

- Mortgage Lending– with the current environment of laws and regulations, residential mortgage lending has become complex. Residential RE loans take longer to complete and need extreme accuracy in documentation and adherence to compliance rules.

- Commercial & Agricultural Lending – These are the relationship loans to our high-value customers. These loans are more unique and individualized in structure. The lenders for these loans need to have sophistication in building relationships and structuring credit.

- Retail Banking– This includes deposit account products and consumer loans. The customer service advantage is efficient delivery to the mass market with a personalized touch.

These various services have different workflows, different customer expectations, and different timings for funding.

Bank customers use all three delivery channels (Commercial Lending, Mortgage Lending, and Retail Banking) when they have the need. A community bank can maximize customer satisfaction and product penetration by realizing that the bank should not operate as isolated departments, but work towards providing customers full-service delivery.

When it comes to banking services, customers often have needs that span across different areas such as commercial lending, mortgage lending, and retail banking. As a result, a community bank can greatly improve customer satisfaction and increase product penetration by recognizing the importance of providing customers with a full-service delivery.

While it may be tempting for banks to operate as isolated departments, this can ultimately limit the bank's ability to meet the diverse needs of its customer base. By taking a more holistic approach, banks can ensure that customers have access to the full range of services they require, regardless of the specific department they initially interact with.

This approach not only helps to improve customer satisfaction, but it can also help to drive greater product penetration. By providing customers with a comprehensive set of services, banks can increase the likelihood that they will choose to work with the bank across multiple areas, rather than seeking out alternative providers for different needs.

Overall, it is clear that community banks can benefit greatly from taking a full-service approach to delivery. By working towards a more integrated and customer-centric approach, banks can improve their ability to meet customer needs and drive long-term growth and success.

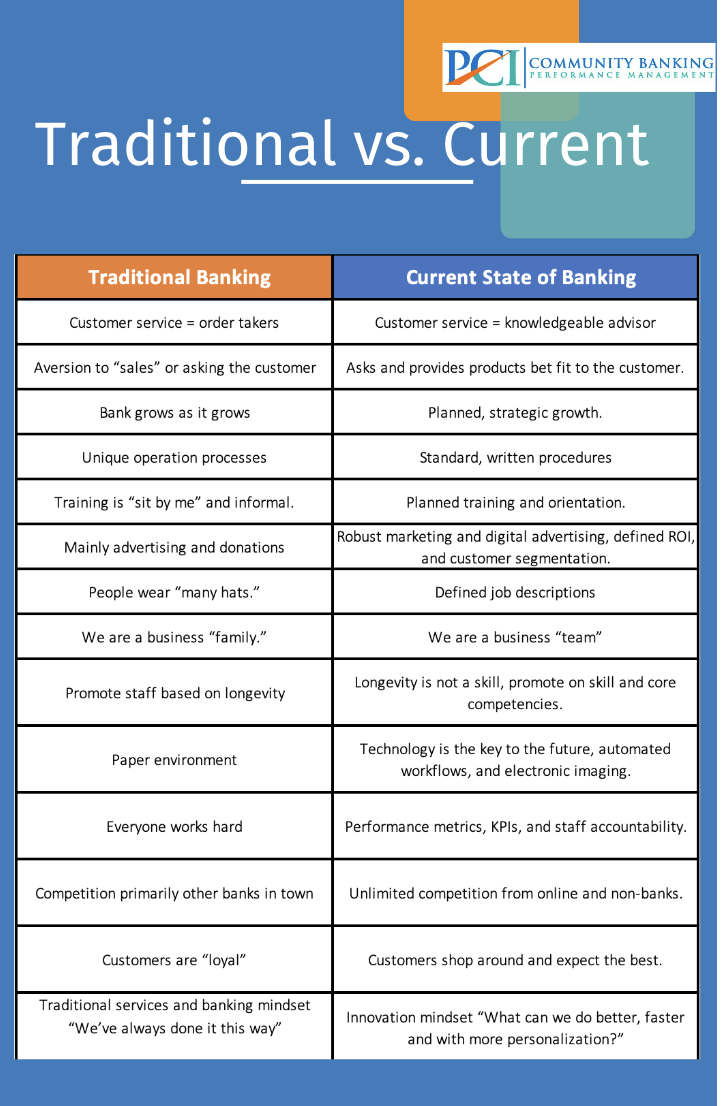

The Mandate for Change | Core Elements

Community Banking is changing dramatically. The following outlines some of the “traditional” aspects of banking and the “now” approach. These fundamental changes will require all community banks to approach their strategies and tactics differently now than in the past.

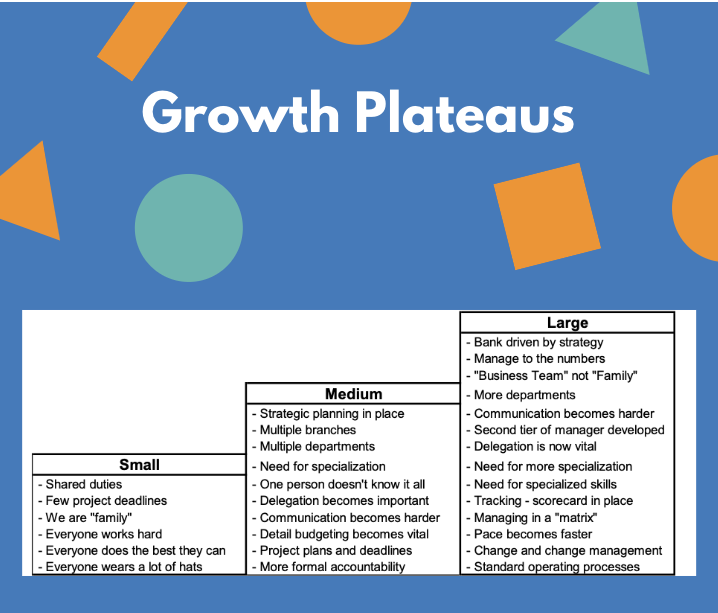

The Mandate for Change | Plateaus

Another factor is the growth plateaus that all banks tend to go through. When a bank is small, communication is easy, everyone helps out and staff “wear lots of hats”.

As a bank progresses through the growth plateaus, a more formalized structure must be in place. Communication becomes more difficult, various departments need to be involved in decisions, and managing the “matrix” becomes important.

The growth of a bank is a complex process that involves a series of plateaus. In the beginning, when a bank is small, communication is easy, and everyone is willing to help out. Staff members wear multiple hats, and everyone is aware of every aspect of the business. However, as the bank grows, a more formalized structure is necessary. Communication can become more challenging, and various departments must be involved in decision-making processes. In such cases, managing the "matrix" becomes crucial.

A more formalized structure means that roles and responsibilities are clearly defined, and there is less overlap between roles. Departments become more specialized, and communication becomes more formalized. In this way, the bank can operate more efficiently. However, it is also important to ensure that the bank's culture and values are not lost as it grows. The bank should strive to maintain a sense of community, even as it becomes more complex.

Managing the matrix is essential in ensuring that the bank's various departments work together effectively. This involves coordinating the work of different teams, managing conflicts, and ensuring that everyone is working towards the same goals. It can be challenging, but it is crucial to the success of the bank. By managing the matrix effectively, the bank can continue to grow and thrive.

The Five Ways to Improve Efficiency

Efficiency is the key to success. While strategies, project plans, and innovative products can be critical to a bank’s success, efficiency must be a constant driver. There are only five ways to improve efficiency. Each component must be examined and changes made as needed to improve.

Efficiency is indeed a critical component of success for any organization, including banks. While there are various strategies, plans, and products that can contribute to a bank's success, it is important to prioritize efficiency as a constant driver of progress.

Fortunately, there are five key ways to improve efficiency that can be examined and implemented as needed.

- The first way to improve efficiency is by optimizing processes. This involves identifying the steps in a particular process and eliminating any unnecessary or redundant steps to streamline the process.

- The second way is to automate tasks wherever possible, which can save time and reduce the risk of error.

- The third way is to invest in technology that can help improve efficiency, such as software that can automate tasks or provide real-time data analysis.

- The fourth way is to train employees in best practices and provide them with the tools they need to work efficiently.

- Finally, the fifth way to improve efficiency is to regularly measure and track performance metrics to identify areas of improvement and adjust strategies accordingly.

By focusing on these five ways to improve efficiency, banks can drive success and stay competitive in an ever-changing market. It is important to remember that efficiency is not a one-time fix, but rather a continuous effort that requires ongoing evaluation and improvement.

1) Standardization – is everyone doing the same job doing it the same way?

- Is there a defined process?

- Is there a written procedure?

- Do we train staff on the right way to do the function?

2) Automation – are we fully utilizing the capabilities of automation?

- Are there features and functions of automation that we have but don’t use?

- Do we have “owners” of our technology who are our in-house experts?

- Is there new/better technology that we can cost-justify?

3) Elimination – Are there tasks that we can simply stop doing?

- Are we duplicating on paper what is done electronically?

- Is there more dual control and check back than we need for the risk?

4) Workflow – Do we have the right work on the right desk?

- Should some functions be centralized?

- Are the administrative and processing functions in the right place?

5) Productivity – Do we have the right staff doing the right things?

- Do we have the right skills in our staff?

- Do we measure activity volumes / by department / by staff member?

- Do we then, have the right number of staff for the activity volume?

- Do we have standards of productivity?

- Do we track errors (quality)?

- Do we provide feedback to our employees on their performance?

- Do we hold staff accountable and is there a consequence to good or bad performance?

The Mandate for Change | Making a Difference

The Customer Experience

A clearly defined process, between the sales side and the service-support side, is the foundation of success in any community bank. However, such responsibility cannot be assigned until the “Customer Experience” has been defined. Once defined, it must be in place in every branch and must be measured.

A well-defined process that connects the sales and service-support teams is crucial to the success of any community bank. This process cannot be put in place until the "Customer Experience" has been thoroughly defined. Once the experience has been clearly defined, it must be implemented across every branch and measured consistently.

To define the "Customer Experience," community banks must first understand their customers' needs. This requires gathering feedback and data from customers, including their expectations, preferences, and pain points. This information can be obtained through surveys, focus groups, and other means.

Once the customer experience has been defined, it must be implemented across every branch. This requires collaboration between the sales and service and support teams. Each team must understand their role in the process and work together to provide a consistent and seamless experience for the customer.

To ensure success, the customer experience must be measured consistently. This can be done through various methods, such as customer satisfaction surveys, mystery shopping, and customer feedback. Regularly measuring and analyzing the customer experience allows community banks to identify areas for improvement and make necessary adjustments.

A well-defined process that connects the sales and service-support teams is crucial to the success of any community bank. However, this process must be built on a foundation of clearly defined and implemented customer experience. Measuring the customer experience consistently is also essential to ensure ongoing success.

Employee Training & Development

Make certain employee rewards are aligned with specific, measurable goals, that help to recognize excellent performance and build teamwork. An effective reward system will motivate employees to do what is best for the customer and foster a culture of high-performers. An effective reward system will help reduce “silos” within the bank and promote overall accountability of clearly defined goals, projects, and initiatives.

An effective reward system can play a significant role in motivating your employees to deliver their best performance. However, it is critical to ensure that the rewards are aligned with specific, measurable goals that help recognize excellent performance and build teamwork. This can help foster a culture of high-performers who are motivated to do what is best for the customer.

An effective reward system can also help reduce "silos" within the bank and promote overall accountability of clearly defined goals, projects, and initiatives. This can be achieved by creating a culture where employees are rewarded for collaborating with each other and working towards common goals. By doing so, employees are more likely to work together, share knowledge, and support each other in achieving success.

To ensure that your reward system is effective, it is important to define clear, measurable goals for your employees. This can help ensure that employees understand what is expected of them, and how they will be rewarded for their performance. Additionally, it is important to communicate the reward system clearly to employees so that they understand how they can earn rewards and what they need to do to achieve them.

An effective reward system can be a powerful tool for motivating employees and promoting a culture of high-performers. By aligning rewards with specific, measurable goals, promoting teamwork, and reducing silos, your employees will be more motivated to do what is best for the customer and work towards achieving common goals.

Metrics and Measurements

Lay the foundation of performance tracking bank-wide, to assist management in understanding key areas of performance within their respective departments and teams. These will be measured functions, such as internal service standards, customer service, cross-sell ratios, product knowledge, product promotions, efficiency, and peer group comparisons – all related to key metrics needed by management to drive results.

Performance tracking can be a crucial tool for banks to monitor the success of their operations. By measuring key areas of performance within departments and teams, management can gain valuable insights into what is working well and what needs improvement. Some of the measured functions that are important to track include internal service standards, customer service, cross-sell ratios, product knowledge, product promotions, efficiency, and peer group comparisons.

Internal service standards refer to the quality of service that employees provide to each other. This can include things like how quickly requests are fulfilled, how well they are communicated, and whether they meet agreed-upon standards. Customer service is another key area to monitor, as it is critical to keeping customers happy and loyal. This can be measured by looking at things like customer satisfaction scores, complaint resolution rates, and response times.

Cross-sell ratios are important to track because they can indicate how well employees are able to sell additional products or services to existing customers. By measuring this, management can identify areas where employees may need additional training or support. Product knowledge and promotions are also important to track, as they are critical to increasing sales and revenue. Efficiency is another area to monitor, as it is important to ensure that operations are running smoothly and that resources are being used effectively.

Finally, peer group comparisons can be a valuable tool for banks to benchmark their performance against other institutions in the industry. This can help management identify areas where they may be falling behind and take steps to improve. By laying the foundation for performance tracking bank-wide, banks can gain valuable insights that will help them drive results and achieve their goals.

Strategy Components

Retail Banking Strategy

Retail Banking will support the business banking strategy and, therefore, be aligned with that strategy. Business banking customers need to use and understand the bank's retail services.

Retail services play a crucial role in supporting a bank's business banking strategy. By aligning retail services with the overall business banking strategy, banks can ensure that their business customers are able to effectively use and understand the services provided.

Business banking customers often require a range of retail services, including checking and savings accounts, credit cards, and loans. By providing these services in a way that is aligned with the bank's overall strategy, customers can benefit from a cohesive and integrated experience.

Furthermore, by ensuring that business banking customers are able to effectively use and understand retail services, banks can improve customer satisfaction and loyalty. This can lead to increased revenue and profitability, as satisfied customers are more likely to continue using a bank's services and recommend them to others.

In short, aligning retail services with the business banking strategy is crucial for banks looking to provide a comprehensive and effective range of services to their customers. By doing so, banks can improve customer satisfaction, increase revenue, and drive long-term growth.

Retail will be premised on efficient delivery to the consumer markets. Efficiency is defined, in part, by the speed of delivery of retail products, including consumer loans.

Efficient delivery is indeed a crucial component of the retail industry, especially in today's fast-paced world where consumers demand convenience and quick service. Speed of delivery is a significant factor that contributes to efficiency, particularly when it comes to retail products and consumer loans.

In the community banking sector, speed of delivery is critical when it comes to consumer loans. Many consumers require loans to meet their urgent financial needs, and any delay in loan approval or disbursement can be detrimental to their financial well-being or perceived “ease of use” of bank products. Therefore, financial institutions are also investing in technologies that can help them process loan applications faster and disburse funds quickly to their customers.

Efficiency in retail is closely tied to the speed of delivery of products and services. Community banks must continue to invest in technologies that can help them optimize their processes and meet their customers' expectations for quick and convenient service.

To the extent possible, retail banking will be driven by point-of-sale technologies. This will reduce the need for centralized staff to duplicate what is being completed in the branch.

Retail banking has been undergoing a significant transformation over the past few years, with technological advancements driving much of the change. One of the most significant trends in recent years has been the increasing use of point-of-sale (POS) technologies in retail banking operations. This shift towards POS technologies has been driven by the need to reduce the need for centralized staff to duplicate what is being completed in the branch.

By leveraging these technologies, retail banks can streamline their operations, making it easier for customers to access their services while reducing the need for centralized staff. This approach has the potential to make banking more convenient and accessible for customers, while also reducing costs for banks.

However, there are also some challenges associated with this shift towards POS technologies. For example, banks will need to ensure that these technologies are secure and reliable and that they can effectively integrate with existing banking systems. Additionally, banks will need to ensure that customers are comfortable using these technologies and that they can provide adequate support to those who may have questions or concerns.

Overall, while there are challenges associated with this shift towards POS technologies, there is no doubt that this trend will continue to shape the future of retail banking. By embracing these technologies, banks can offer more convenient and accessible services to their customers, while also reducing costs and improving efficiency.

Customers will be encouraged to use various technologies available. This will be the preferred way for customers to access their bank accounts and conduct transactions. However, using technology will not be mandated. Customers who prefer phone support will get a local banker every time they call the bank.

As technology continues to advance, it is becoming increasingly common for banks to encourage their customers to use digital channels to access their accounts and conduct transactions. This trend is no different for our bank, where we are proud to offer a wide range of technology-based options to our customers.

We believe that the convenience of technology will greatly benefit our customers by providing them with secure and easy access to their accounts from anywhere at any time. Our customers can use our website and mobile app to view their account balances, transfer funds, pay bills, and even deposit checks from their smartphone or tablet. Additionally, we offer a range of digital tools, such as financial management tools and budgeting apps, to help our customers better manage their finances.

At the same time, we understand that not everyone is comfortable using technology or may prefer to speak with a live person. That's why we will never mandate the use of technology. We are committed to providing our customers with exceptional customer service, and for those who prefer phone support, they will always be able to speak with a local banker every time they call our bank.

We strongly encourage our customers to take advantage of the many technology-based options we offer, but we also understand the importance of offering personalized support to meet the unique needs of each customer.

Technology will also be used for sales and marketing efforts. This will include the use of social media, mobile banking, and online account opening. Electronic means will be used to reach each customer segment using a personalized branded touch.

In today's world, technology has become an integral part of the sales and marketing efforts of businesses. Social media has become an essential tool for businesses to connect with their customers. With over 3 billion active users across various platforms, it's no surprise that many companies are investing in social media marketing. By creating engaging content and utilizing targeted ads, businesses can reach their desired audience and build brand awareness.

Online account opening has become a game-changer for community banks. With the ability to open an account from anywhere, customers no longer have to physically visit a branch to do business with the bank. This convenience has led to a significant increase in customer acquisition for banks that offer this service.

Technology has revolutionized the way community banks approach sales and marketing. By utilizing social media, mobile banking, and online account opening, businesses can create a personalized branded touch that resonates with each customer segment.

The customer experience will be defined and will be standard in all locations. This provides optimal customer satisfaction and the ability to deepen customer business. Speed of delivery (such as turn-around time for loans) will be one of the measures of customer service.

Providing a consistent customer experience across all locations is a key element in building a strong customer base. Ensuring that all customers receive the same level of service and attention, regardless of location, builds trust and loyalty. By standardizing the customer experience, businesses can also identify areas for improvement and make necessary changes to enhance customer satisfaction.

One of the key measures of customer service is speed of delivery. This is particularly important in banking, where customers often require quick turn-around times for loans or other financial services. By prioritizing speed of delivery, businesses can ensure that customers receive the attention they need in a timely manner, improving their overall experience.

Operating procedures will be the same for all processes within each branch and for all branches. This will improve efficiency, and accuracy and enhance the customer experience.

Standardizing operating procedures across all branches and processes can have numerous benefits for the bank. Firstly, it can greatly improve efficiency by eliminating any unnecessary steps or variations in the process. This can result in faster turnaround times and lower costs, ultimately making the business more competitive.

In addition, standardizing procedures can also improve accuracy and consistency, as employees will have a clear set of guidelines to follow. This can help to reduce errors and minimize the risk of mistakes, which can be particularly important in industries with high safety or quality standards.

Perhaps most importantly, standardization can greatly enhance the overall customer experience. By ensuring that all bank branches and processes are consistent, customers can expect the same level of service and quality no matter where they go. This can help to build trust and loyalty, ultimately leading to increased customer retention and growth for the bank.

The Customer Experience

Every banker thinks that they provide excellent customer service. However, in retail banking, it is important to take advantage of the customer’s time with the banker to maximize the customer experience – for the good of the customer and for the good of the bank.

The bank should develop a standard customer experience for each position within the retail area. The standard customer experience for a new account might have the following elements 1) Point of sale and 2) New Customer Account follow-up calls.

You're right, customer experience is crucial in retail banking. It's not enough for a banker to just think they provide great service; they need to take advantage of their time with customers to ensure a positive and efficient experience. One way to do this is by developing a standard customer experience for each position within the retail area.

For example, when opening a new account, the standard customer experience might include two main elements: point of sale and new customer account follow-up calls. At the point of sale, the banker should be welcoming, attentive, and knowledgeable about the account options available to the customer. They should also be able to efficiently process the account opening paperwork and answer any questions the customer may have.

After the account is opened, the banker should follow up with the customer via phone calls to ensure their satisfaction with the account and address any concerns or issues they may have. This shows the customer that the bank values their business and cares about their experience.

By developing a standard customer experience for each position within the retail area, the bank can ensure that all customers receive consistent and high-quality service. This not only benefits the customer but also helps to promote customer loyalty and retention, ultimately benefiting the bank as well.

The Mandate for Change | Sales

Sales strategies in Retail Banking have shifted to maximizing the time that the customer is in the bank to help them understand the products and services that the bank offers and to select and buy the products that best suit their individual needs. With that said, there are several banking opportunities to see a lift in customer engagement.

Retail banking has undergone a shift in sales strategy, focusing on maximizing the customer's time in the bank to help them understand the products and services offered and select the ones that best suit their needs. There are several banking opportunities that can lead to increased customer engagement and satisfaction.

One such opportunity is product bundles. When a customer comes in to open a checking account, the banker can discuss additional products that may fit their banking needs, such as savings accounts, credit cards, or loans.

Referrals to another banking department are also common and necessary. For example, a customer new to town may open a checking account but need a mortgage loan for their new house. The banker can refer them to the appropriate department and ensure a smooth transition.

Segment-specific product promotions are another way to market banking products. These promotions are targeted to specific customer segments and can include products like home equity lines of credit, certificates of deposits, and rewards checking.

By taking advantage of these banking opportunities, customers can receive personalized service and find the products that best fit their needs. This, in turn, leads to increased customer satisfaction and engagement with the bank.

The Mandate for Change | Tools and Talent

Motivating Staff

Motivation is the force that drives employees to desirable actions. Motivation comes from inside a person and how they respond to internal and external stimuli.

One of the most misconstrued notions about employee motivation is that we have no power to motivate others. What we do have the power to do and influence is provide an environment of enthusiasm and opportunity that will allow individual employees to tap into their own motivations.

Motivation is an essential element of employee productivity and job satisfaction. It is the driving force that encourages employees to perform their work to the best of their abilities. While it is true that employees are motivated by their own internal needs and desires, there are several ways in which employers and managers can create an environment that fosters motivation.

One of the most effective ways to motivate employees is by providing them with opportunities for growth and development. This can include offering training programs, career advancement opportunities, and challenging assignments. Employees who feel that they are growing and developing in their roles are more likely to be motivated to perform at a higher level.

Another important factor in employee motivation is recognition and appreciation. Employees who feel valued and appreciated for their contributions are more likely to be motivated to continue to perform well. This can be as simple as providing regular feedback and expressing gratitude for a job well done.

Finally, it is important for employers to create a positive work environment that promotes enthusiasm and energy. This can be achieved through team-building activities, social events, and other initiatives that encourage employees to connect with one another and develop a sense of camaraderie.

While employers cannot directly control employee motivation, they can create an environment that encourages and supports it. By providing opportunities for growth and development, recognizing and appreciating employee contributions, and promoting a positive work environment, employers can help to foster a motivated and engaged workforce.

The Five Components of Job Satisfaction

Setting up a motivating work environment is not an exact science. What works to motivate Employee A may not necessarily work to motivate Employee B. The following are five key components of employee job satisfaction. If an employee feels satisfied in their job, they will be more motivated to do a good job. Interesting and Important work.

1) Provide meaningful work.

Employees who find their work engaging and meaningful will be more invested in their tasks and be more productive.

2) Understanding the direction the company is going.

When employees are informed about a company's goals and objectives, they can better align their work with the company's vision.

3) Understanding what role their department plays in the company's success.

When employees understand how their work contributes to the success of the company, they feel valued and important.

4) Being involved and able to participate in decision-making.

When employees are given the opportunity to offer input and ideas, they feel empowered and invested in their work.

5) A sense of fairness in rewards, recognition, and consequences to performance.

Employees who feel they are being treated fairly are more likely to be motivated and engaged in their work.

Understanding and implementing these five components can help create a motivating work environment for employees. By focusing on job satisfaction, employers can improve productivity and job performance, leading to greater success for the company as a whole.

Priorities

One of the most important elements you can do as a bank leader is communicate clearly with your employees in areas that they are doing well alongside areas for improvement and continued training. The more you are able to objectively measure performance expectations, the easier and more effective your conversations with your employees will be. This helps to not only hold employees accountable but also encourage career development and recognize high-performers.

As a bank leader, clear communication with your employees is crucial to the success of your team. It is important to provide feedback on both areas of strength and areas for improvement, as well as offer opportunities for continued training and career development.

By objectively measuring performance expectations, you can have more effective conversations with your employees that hold them accountable while recognizing high-performing individuals. This approach not only ensures that your team is meeting expectations but also promotes a positive and supportive environment that encourages growth and success.

Remember, effective communication is key to building a strong and successful team.

The following are some areas that are vital to motivate staff:

- Setting objective performance measures for each staff member

- Reviewing expectations at the beginning of the year

- Trusting the ideas and suggestions of the other team members

- Accepting the ideas for improvements that employees suggest

- Letting subordinates select and carry out solutions - delegation

- Accepting criticism from subordinates

- Giving negative feedback to employees

- Criticizing ideas without criticizing the people who present them

- Discussing employees’ job performance with them regularly

- Discussing the organization’s long-range goals with them

- Sharing information about the organization with the team

- Trusting work groups to meet their deadlines

- Allowing employees to disagree with managers in a team setting

- Showing concern for employees’ personal as well as professional goals

- Expressing feelings, such as anger, or discomfort in the team setting

The Mandate for Change | Strategic Priorities